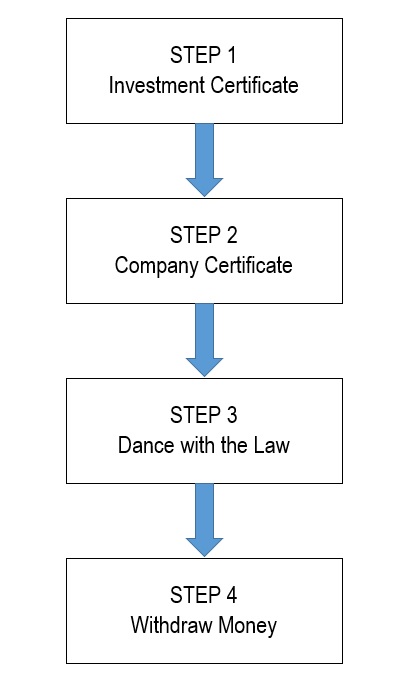

To get a Company Certificate and do business in Vietnam, you need to know four steps:

Step 1 applies to all investors, except investment projects of domestic investors or the economic organizations prescribed in Clause 2, Article 23 of the Law No. 61/2020/QH14 and investment in the form of contribution of capital to, or purchase of shares or capital contributions at economic organizations.

If you are a foreigner, you will need a minimum deposit/charter capital contribution of 3,000,000,000 VND (130,000 USD) to get an Investor Visa. See details here.

Step 2 to be issued a Company Certificate to sell goods and services in Vietnam.

Step 3 is to comply with Vietnam's regulations on accounting, auditing, tax, customs, labor, social insurance, conditional business lines, fire safety, corporate governance and reporting, etc.

Step 4 means you close the business and withdraw the profits back to your home country.

See more: