In Vietnam, foundation/fund means a non-governmental organization established from assets voluntarily contributed by individuals and organizations or under a testament or through a donation of assets, having organization and operation purposes specified in Article 3 of Decree No. 93/2019/ND-CP of the Government on the organization and operation of social funds and charity funds, and granted an establishment license and a charter recognition paper by a competent state agency.

Funds shall be organized and operate for not-for-profit purposes of supporting and promoting the development of culture, education, health, physical training and sports, science, technology, community, and charity and humanitarian activities.

➢ Social fund means a fund organized and operating for not-for-profit purposes of supporting and promoting the development of culture, education, health, physical training and sports, science, and agricultural and rural development activities.

➢ Charity fund means a fund organized and operating for not-for-profit purposes of supporting the remediation of incidents caused by natural disasters, fires, epidemics or accidents, and helping persons falling in difficult or disadvantaged circumstances in need of social assistance.

➢ Not-for-profit purpose means that profits earned in the operation of a fund are not to be divided but are used only for the activities specified in the fund’s recognized charter.

Vietnamese individuals and organizations and foreign individuals and organizations can contribute assets to establish a fund in Vietnam.

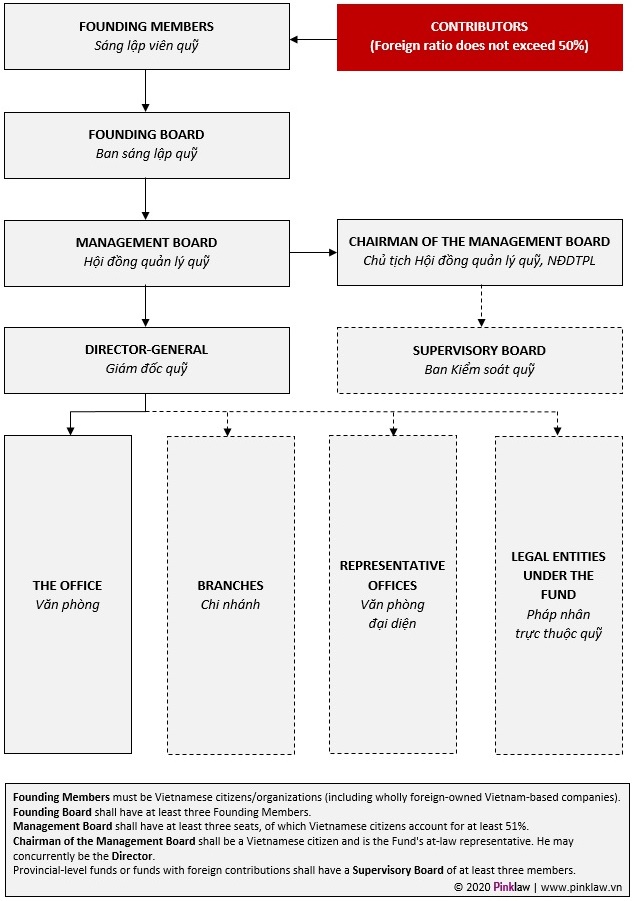

(Organization chart of a Charity/Social Fund under Vietnamese regulations)

1. REQUIREMENTS

*/ Assets to be contributed

The minimum total assets to be contributed to register a wholly domestic-owned fund or a foreign-owned fund are specified as follows:

Fund scope | Wholly domestic | Foreign-owned |

In the commune | 25,000,000 VND | 620,000,000 VND |

In the district | 130,000,000 VND | 1,200,000,000 VND |

In the province | 1,300,000,000 VND | 3,700,000,000 VND |

Nationwide | 6,500,000,000 VND | 8,700,000,000 VND |

At rate 1 USD = 25,000 VND: 620,000,000 VND = 24,800 USD; 1,200,000,000 VND = 48,000 USD; 3,700,000,000 VND = 148,000 USD; 8,700,000,000 VND = 348,000 USD.

*/ Key positions

— Contributors: Vietnamese individuals and organizations and foreign individuals and organizations. (1)

— Founding Members: Vietnamese individuals and organizations only. Foreign-invested Vietnamese organizations (eg FDI companies) appoint a Vietnamese representative. (2)

— Founding Board: Set by the Founding Council and consisting of at least three Founding Members.

— Management Board: Nominated by the Founding Board. At least three members with the majority of Vietnamese members.

— Chairman of the Management Board: Elected by the Management Board.

— Director: Appointed by the Management Board among its members or hired.

— Accountant: Appointed by the Management Board at the proposal of the Director.

— Supervisory Board: Decided and established by the Chairman of the Management Board according to the resolution of the Management Board.

(1), (2): Owners

As such, a fund would need to have at least three Contributors/Founding Members, three members for the Management Board, and one Accountant.

2. STEPS

To publicize your fund, you'll need to go through four steps:

Step 1: Receiving the fund certificate (8-10 weeks)

Step 2: Making announcements in 3 consecutive issues (1 week)

Step 3: Receiving a confirmation letter from the bank on your deposit (1 week)

Step 4: Receiving the decision on recognition of the fund from a competent state agency (6 weeks)

3. OVERALL BUDGET

Overall, contributors will contribute VND 8,700,000,000 (~USD 348,000) or more to register an inter-provincial fund with foreign capital contributions. The service fee will start from VND 60,000,000-100,000,000.

4. LEGAL GROUNDS

— Decree No. 93/2019/ND-CP on the organization and operation of social funds and charity funds

— Decree No. 93/2021/NĐ-CP

— Circular No. 04/2020/TT-BNV